OVERVIEW:

With the world in the midst of the COVID-19 pandemic that has precipitated a severe global economic contraction, regulators and financial market professionals across the world have moved rapidly to prevent another financial crisis. As part of the regulatory initiatives intended to reduce the real economy impact and financial market strain, some regulators have been calling for coordinated, worldwide action to suspend all bank dividends for the foreseeable future. From our perspective, a blanket prohibition that does not consider how the real economy impact of dividends varies across jurisdictions — depending on banks’ stability, dividend frequency, payout ratio, and the recipients of the funds — risks unintended consequences.

Proponents of dividend suspension are calling for concerted regulatory action to allow banks to build capital and get much needed

funding to businesses and households affected by the COVID-19 pandemic. The intense focus on dividends is heightened by the inability to predict, with any certainty, how long the pandemic will last, or what the shape and durability of the economic recovery will be. For some sectors of the economy facing drastic declines in demand for their products this is an existential threat, with numerous firms unlikely to survive the crisis. There is simply no playbook for putting vast swathes of the global economy on pause.[1]

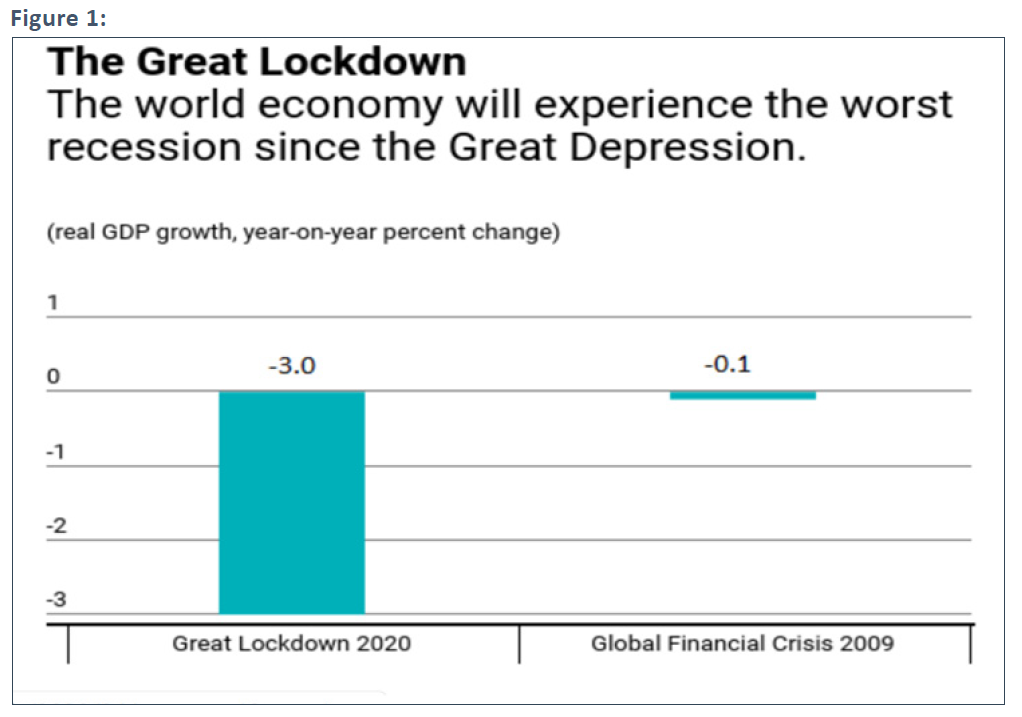

The International Monetary Fund (IMF) recently revised its World Economic Outlook from growth of 3.3% in 2020 to a severe economic contraction with the global economy falling sharply by 3%. In the IMF’s words: “This makes the Great Lockdown the worst recession since the Great Depression, and far worse than the Global Financial Crisis (GFC).” And this is the new baseline case.

Similar warnings regarding the severity of the economic contraction are reflected in the forecasts of the world’s central banks and major financial institutions. Preliminary Canadian, European and U.S. data for the first quarter of 2020 have confirmed that the magnitude and speed of the plunge in economic activity is unprecedented in the post-WWII period.

Increased capital will be required for some unpredictable length of time to withstand the surge in credit demand, loan losses, increased expenses, as well as impaired profit. These financial stresses make it essential to bolster the ability of commercial banks to undertake their important policy role in getting much needed liquidity, at record speed, into the hands of large corporations, small and medium-size businesses, and households. In contrast to the GFC, when problems originated in and were dominated by the financial sector, the COVID-19 pandemic is an external shock generating major financial market strains, in particular the massive requirement for liquidity to support the real economy.