OVERVIEW:

While, collectively, we must strive to save lives, we must also strive to save livelihoods during and after the pandemic. Ensuring safety and security within our communities should continue to be priorities for government, regulators and industry during this crisis; however, we must also look to the future. Following the global financial crisis of 2008/2009, regulatory enhancements generally resulted in financial institutions being significantly strengthened. As referred to in our GRI report, once we move through this current crisis stage, we will have to deal with transition and, then, forge a sustainable path — a path that has been referred to as the “new normal”. We know from past crises that financial institutions entering those crises in strong shape were far better positioned to be able to pivot and prosper when the “new normal” arrived.

OUR CURRENT REALITY – UNDERESTIMATED RISK

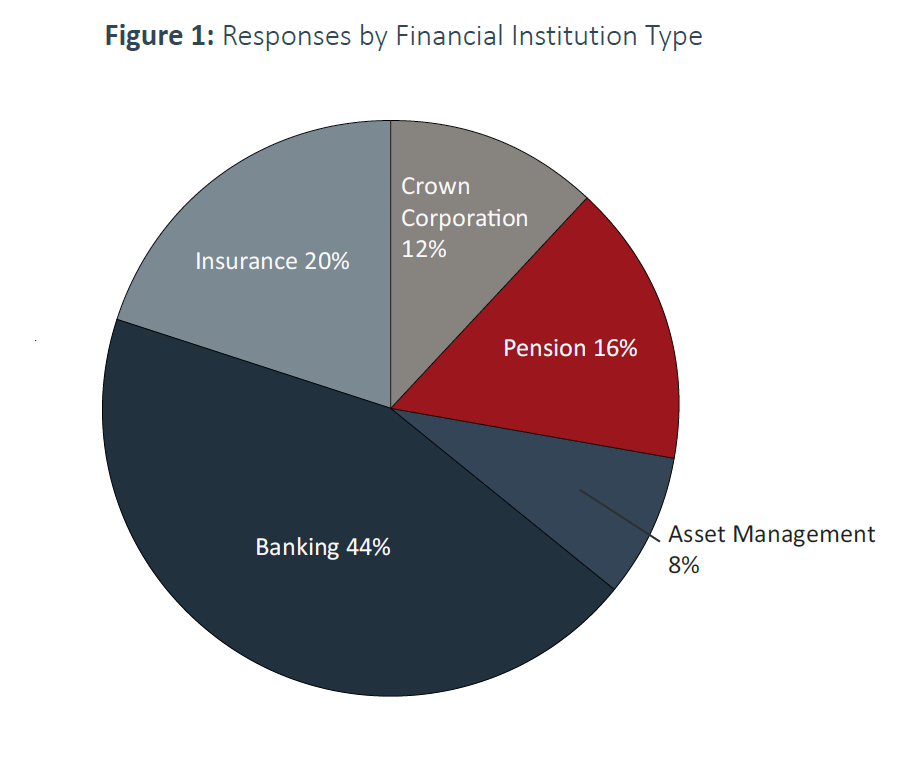

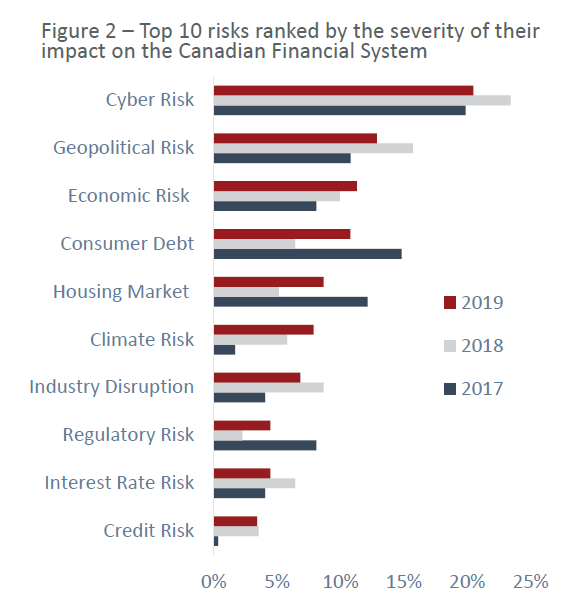

Although it is unlikely that any financial institution in Canada failed to identify pandemics as an emerging (or potential) risk, financial institutions did not identify pandemics among the top 10 risks to the Canadian Financial System. Key aspect to this underestimation was failure to fully appreciate the significant contagion effects of a global pandemic. It is interesting to note that, with the possible exception of climate risk, a pandemic event is a key catalyst for all of the “Top 10” risks identified by our membership.