Executive Summary

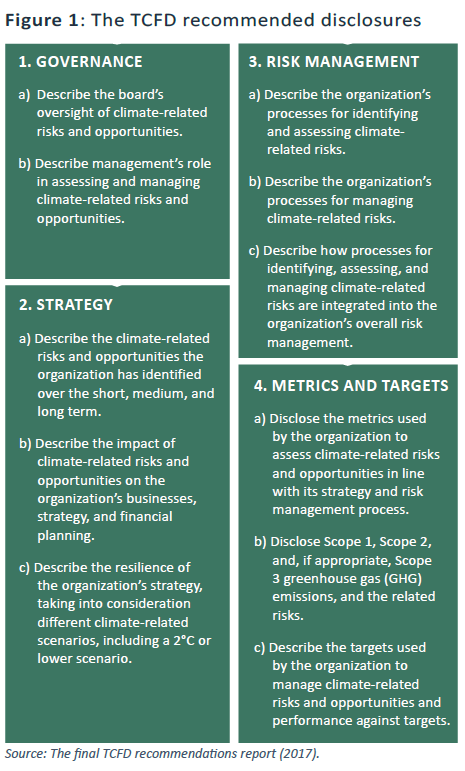

In this article, we review the current practices that financial institutions are employing, globally, to comply with the recommendations developed by the Task Force on Climate-related Financial Disclosure (TCFD) (Figure 1). We highlight some of the challenges and obstacles that these institutions have faced when implementing those recommendation, and offer suggestions on how to deal with them. In line with strong support for the TCFD recommendations, we call for continued actions by the financial sector, governments, and standard-setting organizations in order to facilitate more effective and thorough disclosures of climate-related issues. The key areas for improvement that we have identified are as follows:

- Financial institutions should establish an effective governance structure for climate-related risks.

- Financial institutions should include emergent climatic risks in the scenario analysis.

- Standard-setting organizations should develop industry- and region-specific reference scenarios for more comparable disclosures.

- Standard-setting organizations should develop detailed criteria for materiality analysis.

- Governments should support an orderly transition to a lower-carbon economy through early strategic planning and transparent policy signals.

- Policy makers should make climate-related disclosures mandatory.

In June 2019, Canada’s Expert Panel on Sustainable Finance released 15 recommendations focused on spurring the essential market activities, behaviours, and structures needed to bring sustainable finance into the mainstream. These recommendations are grouped into three pillars: (1) The Opportunity, (2) Foundations for market scale, and (3) Financial products and markets for sustainable growth. As the navigated through this, much attention was paid to the industry-led, international Task Force on Climate-related Financial Disclosures (TCFD).

The TCFD, championed by Mark Carney and Michael Bloomberg in 2015, set out to develop recommendations on how companies should disclose climate-related risks and opportunities. Support for the TCFD is broad-based with 785 companies, 340 investors with over $34 trillion, 36 central banks, and five governments, Canada among them, having committed to uphold its recommendations.

Additionally, the Canadian Securities Administrators (CSA) has recently issued guidance to issuers on how they might approach preparing disclosures of material climate-related risks. Again, their guidance references the TCFD recommendations. As we look to strengthen our climate-related governance, strategy, risk management, metrics and targets, there is much to gain from following the TCFD recommendations.